Found Money: Tax advantages of precious metal and business ownership

Before I joined 7K metals, I was researching and thinking about why I would decide to get involved and how I would benefit from collecting coins and also running a home based business. I knew that I would accumulate a collection of coins using the autosaver program. I would be saving money in a solid investment of silver that had great potential to grow in value because of the potential of silver prices increasing over time as well as the growth potential based on the future demand for an MS70 collectible coin. I also knew that if I shared this opportunity with others that I could potentially make more money as a business owner. The thing that really pushed me over the edge was the potential tax savings.

There were two tax advantages that got me excited to participate in once I had joined:

Gold/Silver eagle coins

Being a business owner.

First of all, I am not a tax advisor. I am just sharing what I have learned that will help me to save money. I plan on using the services of a tax advisor to make sure that I am properly taking full advantage of the tax laws and I would suggest anyone else to do the same.

Precious metal dealers are required to report to the IRS on a 1099-B when they purchase from a customer certain types of coins, bars, etc. and certain amounts. They generally have a list of those they can provide. When purchasing these, it is important to keep in mind that one day if you want to sell these back to a dealer then you would want to be aware how that will affect your taxes. When it comes to gold and silver eagle coins, precious metals dealers are not required to report any amount that a customer is selling back to them. If you think about it, that is a very similar tax advantage as a Roth IRA. Also, they have to report if they purchase any amounts above $10,000 in a single transaction of precious metals to comply with anti-money laundering laws on a Form 8300. So, when the time comes that you decide to sell back gold or silver eagle coins that you also keep that number to $10,000 at a time or per day. I thought that was pretty cool!

There are several tax advantages of being a business owner. Many years ago, I used to take those advantages but because my business as an insurance agent became too time consuming and was not making enough money I had to go back to working as a W-2 employee where there weren't many tax advantages. I knew that I needed to start a business again but I also knew how difficult it can be financially. When I came across 7K, I realized that I could start this business part time with a small investment. On top of that, I could go back to getting all the tax advantages of owning a business. Every year I had to come up with an extra $5000 dollars to pay my income taxes even with doing a fair amount of withholding.

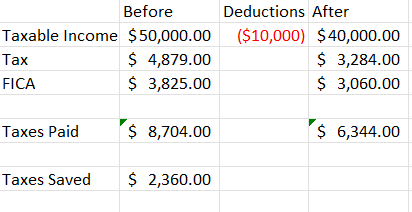

My hope is that for this tax year, I will pay much less. Maybe enough to cover what I have invested into starting the business. The types of deductions I have been able to track include: office space in my home, mileage on my vehicles when traveling to discuss business, meals when discussing business, cell phone bill, internet bill and product purchases for the business. There are several more deductions and I will need professional help to implement those. Here is a simple diagram of what I hope to do.

The cost of being a member of 7k Metals and participating in the Auto Saver program is around $2000 for the year. As you can see the taxes saved pay for business!

It was a no brainer when I saw this opportunity to save on taxes and essentially pay for my investment into the business. And also potentially save on taxes when I sell my Silver and Gold Eagle coins!